Cards in my Wallet – April 2016

Having several cards, let’s me maximize the cash back I can get. Having a great wife to share credit card perks is also an excellent way to get more cash back. As you may know, we started building our credit history in the USA a couple of years ago, since then we got several cards with different levels of cash back. All cards have at least 1% in general purchases, then it grows to 1.5%, 2%, 3% even 5% and 6% in some purchases. The card have restrictions in what you can buy to get the highest cash back and how much you can use in a month or in a quarter (3 months).

I’m always looking for ways to get the most cash return for my purchases, trying not to buy more things just to get more cash back. Because “buying more just to get more cash back” is not a way to save, and here in ‘Libre sin Deudas’ we share our experiences so others can save and not go into debt, so we can be free. April is the start of a new quarter and that’s the month when a couple of our cards change categories. Those cards offer 5% cash back in some purchases that every 3 months change. Some people don’t like the card that changes categories because a) you have to register before the quarter to that promotion, if not, you will most likely get only 1% and b) some people don’t use their cards that much or at all with some categories.

The cards that will have a place in my wallet starting April 1st are:

Discover IT

This quarter Discover IT card gives 5%* back in all purchases at restaurants and the movies. With the prices at some restaurants and movies every little bonus helps. This is a category that use maybe once every couple of weeks, so there is no way that I can get near the limit of $1,500 per quarter. There are people that use to have lunch everyday, I guess they can get to $1,500 pretty fast. Remember, if you go over the limit then your purchases will only give you 1%*.

Chase Freedom

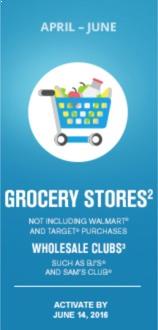

This quarter Chase Freedom 5% category is grocery stores. One common thing about this category is that usually excludes Wal-Mart, Target and Wholesale Clubs, so this quarter is interesting to see that the Freedom card is in fact including Clubs in the 5% category. Not even Sam’s club credit card has a 5% bonus like this one. Last quarter didn’t use my Freedom and only used Discover (they had the same categories).

Capital One Venture

The Capital One Venture card always offer unlimited 2% bonus miles. I usually prefer cash back but this quarter I’ll use my Venture for all other things that are not included with my other cards. I want to get extra miles for summer vacation where I can use it to ‘erase’ travel purchases.

One other thing that we usually buy is gas for our card. Last quarter we used Discover for 5%* cash back, this quarter we are going to use my wife’s Sallie Mae credit card, it gives 5% on gas but only up to $250 a month paid at the pump. We only buy around $120 a month, we will not get over that limit.

What do you think about my card selection? Any recommendations?

*Just a note to new Discover IT users, there is a new cardholder promotion that all cash back that you get your first year, Discover will match that and will give it as a bonus after the first 12 months. So in fact the 5% cash back becomes 10% and 1% becomes 2%